Freehold vs leasehold condos – Which is the best choice?

An investor would do better to focus on the key principles. What are the prices of surrounding properties, what amenities do the URA master plan suggest, and what is the rental yield? Those issues matter much more than whether a unit is freehold or leasehold.

For home owners, do not make too many assumptions about where you and your grandchildren will be living. Family structures and places change. Family members migrate, children move out, and you may well want a change of scene 40 years from now. So before paying the premium for a freehold unit, remember this: 99 years is not forever, but you don’t need forever. You just need long enough.

A holdover from the Colonial era are properties with 999 year leases. This is, for all intents and purposes, similar to freehold.

Note that in any case, there are provisions that allow the government to reclaim the land for vital infrastructure or security purposes. If your house is in the way of a major highway, the fact that it’s freehold is not going to save it. There is also the possibility of en-bloc redevelopment. If a developer makes an en-bloc attempt for your freehold condo, and the other residents agree to it, you’re still going to be moving out.

As a (very loose) rule of thumb, the initial sale price of a freehold unit (new sale) tends to be 10 to 15 percent higher compared to a leasehold unit in the same area.

Now that’s out of the way, let’s look at the never-ending dispute of prices:

Now that’s out of the way, let’s look at the never-ending dispute of prices:

So it should come as no surprise that, for the past two to three decades, analysts and investors have been arguing about the price effects of leasehold versus freehold. There are a few common conclusions that we can arrive at however:

The most significant difference is at the 40 year mark. Most banks will restrict financing for leasehold units that are 40 years old. It is also not possible for buyers to use their CPF, if they want to purchase a property with 30 years or less on the lease. As a result, the value will fall drastically compared to that of a freehold unit.

However, few properties in Singapore reach such an age before being redeveloped. To our knowledge there are no condos at this point in their lease, given that the oldest (possibly Lutheran Towers) was completed in 1974. It’s unlikely that residents will not give in to an en-bloc when their condos have just 30 or 40 years left.

(For public housing, HDB flats tend to be renewed by the Selective En-Bloc Redevelopment Scheme (SERs) before their lease runs too low).

But if it worked that neatly, we could just compare the en-bloc price of a freehold unit and a leasehold unit, and declare “Development X is cheaper because it is leasehold”. In reality, that would be a misleading comparison.

En-bloc offers are affected by a range of factors, such as the state of the market, the zoning laws, and the amenities that have been built up. For example, if zoning laws dictate that a freehold development cannot be replaced by a condo of the same height (we believe this may be the case with Peace Mansions), then the en-bloc price may be lower even if it’s freehold; less vertical space means fewer units to build and sell.

Likewise, it is nearby amenities – such as construction of train stations, malls, and schools – that developers factor into their en-bloc bid. And of course, it’s hard to factor in all that at the initial time of purchase (you don’t know what will be around 30 or 40 years down the road).

For example, say you buy a leasehold condo that is $1 million, and generates $3,000 a month in rent. This is a rental yield of 3.6 percent.

Now say you buy a freehold counterpart, in the same area, and it costs 15 percent more. That’s $1,150,000. Now will your rental income increase? Unlikely, as it does not matter to the tenant whether you have a 99 year leasehold or a freehold. You will probably still get $3,000 in rental income.

The total rental yield is thus 3.1 percent, making it less attractive to a landlord.

This is one of the reasons landlords like to look for older leasehold properties, which may lead to lower capital to purchase, and higher yields. You can browse for some of Singapore’s best valued listings on 99.co.

An investor would do better to focus on the key principles. What are the prices of surrounding properties, what amenities do the URA master plan suggest, and what is the rental yield? Those issues matter much more than whether a unit is freehold or leasehold.

For home owners, do not make too many assumptions about where you and your grandchildren will be living. Family structures and places change. Family members migrate, children move out, and you may well want a change of scene 40 years from now. So before paying the premium for a freehold unit, remember this: 99 years is not forever, but you don’t need forever. You just need long enough.

An investor would do better to focus on the key principles. What are the prices of surrounding properties, what amenities do the URA master plan suggest, and what is the rental yield? Those issues matter much more than whether a unit is freehold or leasehold.

For home owners, do not make too many assumptions about where you and your grandchildren will be living. Family structures and places change. Family members migrate, children move out, and you may well want a change of scene 40 years from now. So before paying the premium for a freehold unit, remember this: 99 years is not forever, but you don’t need forever. You just need long enough.

99 years, 999 years, and Freehold: Defining the terms

A freehold property can be held by the owner indefinitely. A 99 year leasehold property reverts back to the state, upon the expiry of its lease.A holdover from the Colonial era are properties with 999 year leases. This is, for all intents and purposes, similar to freehold.

Note that in any case, there are provisions that allow the government to reclaim the land for vital infrastructure or security purposes. If your house is in the way of a major highway, the fact that it’s freehold is not going to save it. There is also the possibility of en-bloc redevelopment. If a developer makes an en-bloc attempt for your freehold condo, and the other residents agree to it, you’re still going to be moving out.

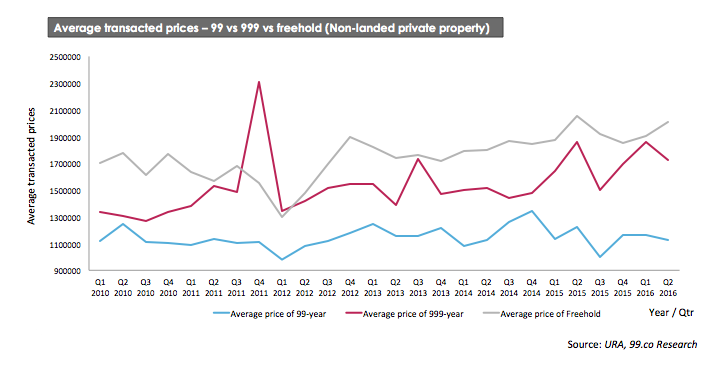

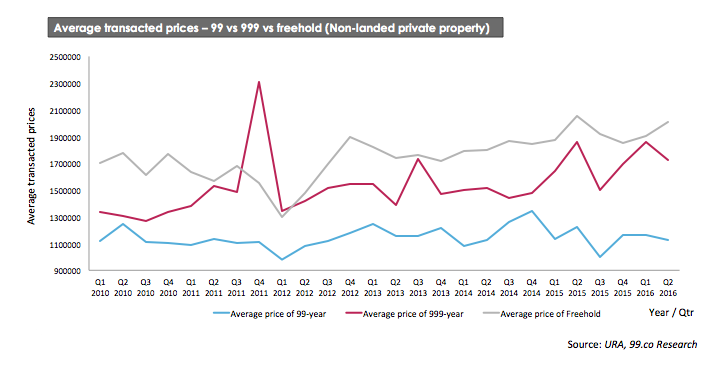

As a (very loose) rule of thumb, the initial sale price of a freehold unit (new sale) tends to be 10 to 15 percent higher compared to a leasehold unit in the same area.

Now that’s out of the way, let’s look at the never-ending dispute of prices:

Now that’s out of the way, let’s look at the never-ending dispute of prices:Which is worth more, 99 years or freehold?

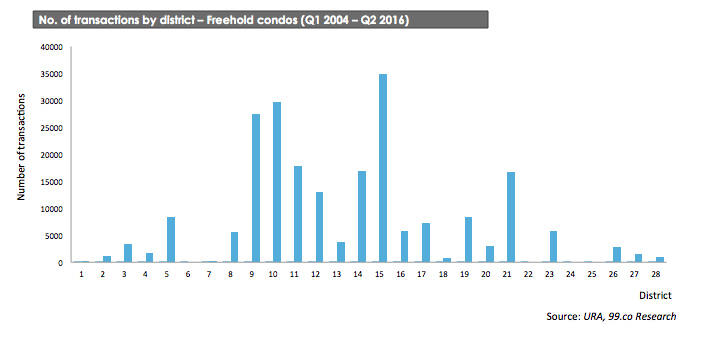

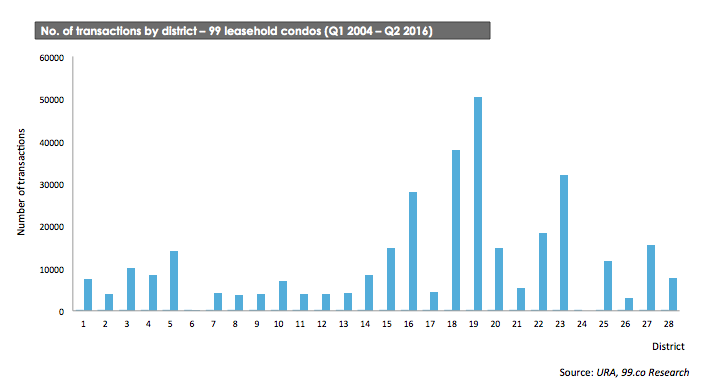

This question is not easy to answer, as it is difficult to isolate individual causes of property value. For example, a unit with 70 years left on its lease, but is located in the Central Business District (CBD), will probably still be be worth more than a freehold unit on the outskirts of Punggol. Likewise, if a freehold property is situated closer to a MRT station, it can be hard to tell how much of the higher valuation is due its freehold nature, and how much is related to its accessibility.

So it should come as no surprise that, for the past two to three decades, analysts and investors have been arguing about the price effects of leasehold versus freehold. There are a few common conclusions that we can arrive at however:

- Price differences occur at the 78 and 30 year mark

- In theory, freehold fetches a better price during en-bloc

- Leasehold is better for rental yields

- The advantage of freehold is more theoretical than practical

Price differences occur at the 21 and 40 year mark

The most significant difference is at the 40 year mark. Most banks will restrict financing for leasehold units that are 40 years old. It is also not possible for buyers to use their CPF, if they want to purchase a property with 30 years or less on the lease. As a result, the value will fall drastically compared to that of a freehold unit.

However, few properties in Singapore reach such an age before being redeveloped. To our knowledge there are no condos at this point in their lease, given that the oldest (possibly Lutheran Towers) was completed in 1974. It’s unlikely that residents will not give in to an en-bloc when their condos have just 30 or 40 years left.

(For public housing, HDB flats tend to be renewed by the Selective En-Bloc Redevelopment Scheme (SERs) before their lease runs too low).

In theory, freehold fetches a better price during en-bloc

But if it worked that neatly, we could just compare the en-bloc price of a freehold unit and a leasehold unit, and declare “Development X is cheaper because it is leasehold”. In reality, that would be a misleading comparison.

En-bloc offers are affected by a range of factors, such as the state of the market, the zoning laws, and the amenities that have been built up. For example, if zoning laws dictate that a freehold development cannot be replaced by a condo of the same height (we believe this may be the case with Peace Mansions), then the en-bloc price may be lower even if it’s freehold; less vertical space means fewer units to build and sell.

Likewise, it is nearby amenities – such as construction of train stations, malls, and schools – that developers factor into their en-bloc bid. And of course, it’s hard to factor in all that at the initial time of purchase (you don’t know what will be around 30 or 40 years down the road).

Leasehold is better for rental yields

For example, say you buy a leasehold condo that is $1 million, and generates $3,000 a month in rent. This is a rental yield of 3.6 percent.

Now say you buy a freehold counterpart, in the same area, and it costs 15 percent more. That’s $1,150,000. Now will your rental income increase? Unlikely, as it does not matter to the tenant whether you have a 99 year leasehold or a freehold. You will probably still get $3,000 in rental income.

The total rental yield is thus 3.1 percent, making it less attractive to a landlord.

This is one of the reasons landlords like to look for older leasehold properties, which may lead to lower capital to purchase, and higher yields. You can browse for some of Singapore’s best valued listings on 99.co.

The advantage of freehold is more theoretical than practical

An investor would do better to focus on the key principles. What are the prices of surrounding properties, what amenities do the URA master plan suggest, and what is the rental yield? Those issues matter much more than whether a unit is freehold or leasehold.

For home owners, do not make too many assumptions about where you and your grandchildren will be living. Family structures and places change. Family members migrate, children move out, and you may well want a change of scene 40 years from now. So before paying the premium for a freehold unit, remember this: 99 years is not forever, but you don’t need forever. You just need long enough.

No comments:

Post a Comment